The latest from Benchmark Email

Tips, tricks, and best practices for the busy email marketer.

Latest Posts See all articles

Marketing

April 18, 2024 4 min read

Mastering Email Marketing Without Overwhelming Yourself: A Guide for Busy Marketers

April 18, 2024 4 min read

Social Media

April 17, 2024 6 min read

How to Make Your Social Media Efforts Compliment and Amplify Your Email Marketing

April 17, 2024 6 min read

Email Marketing

April 16, 2024 5 min read

Email Design Trends: What Catches the Subscriber’s Eye in 2024?

April 16, 2024 5 min read

Email Marketing

April 11, 2024 6 min read

How to Fake it Till You Make it: The Email Marketer Edition

April 11, 2024 6 min read

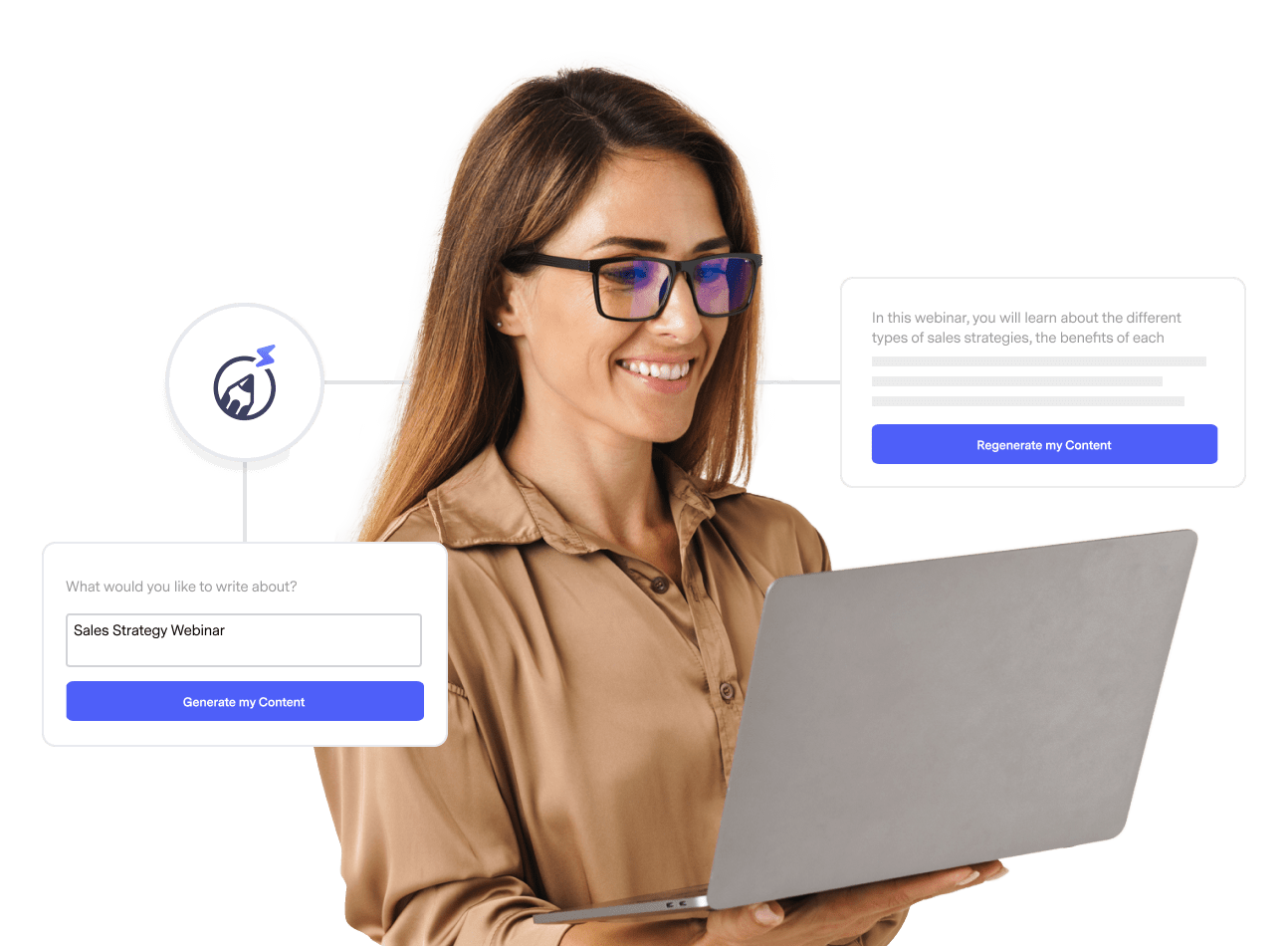

Work Smarter, Not Harder

Create emails in a snap with our AI-powered email copy tool. Try it for free with a free Benchmark Email account.

SIGN UP FREE

Trending Posts See all articles

Email Marketing

September 7, 2021 6 min read

Why Your Emails Are Going to Spam and Ways You Can Put a Stop to It

September 7, 2021 6 min read

Marketing Automation

March 23, 2018 8 min read

Top 5 Email Marketing Automation Triggers You Should Know

March 23, 2018 8 min read

Benchmark Recommends

See all articles

Marketing

Mastering Email Marketing Without Overwhelming Yourself: A Guide for Busy Marketers

| April 18, 2024 4 min read

Social Media

How to Make Your Social Media Efforts Compliment and Amplify Your Email Marketing

| April 17, 2024 6 min read

Email Marketing

Email Design Trends: What Catches the Subscriber’s Eye in 2024?

| April 16, 2024 5 min read