Would you be upset if your bank manager left for the weekend without locking the doors and informed you on Monday morning that your safety deposit box had been looted? What if the valet parking attendant left the keys in your car and it got taken for a joy ride? Or what about if an airline dropped off your baggage on the side of a road instead of on the terminal carousel? Of course you’d be furious at such incompetence and laxity, and you’d have some very good reasons! Then why do you habitually practice very similar slackness with your own precious personal data, including the financial passwords that can empty out your accounts just as efficiently as any bank robber?

Your Data Compromised while You’re in the Bathroom

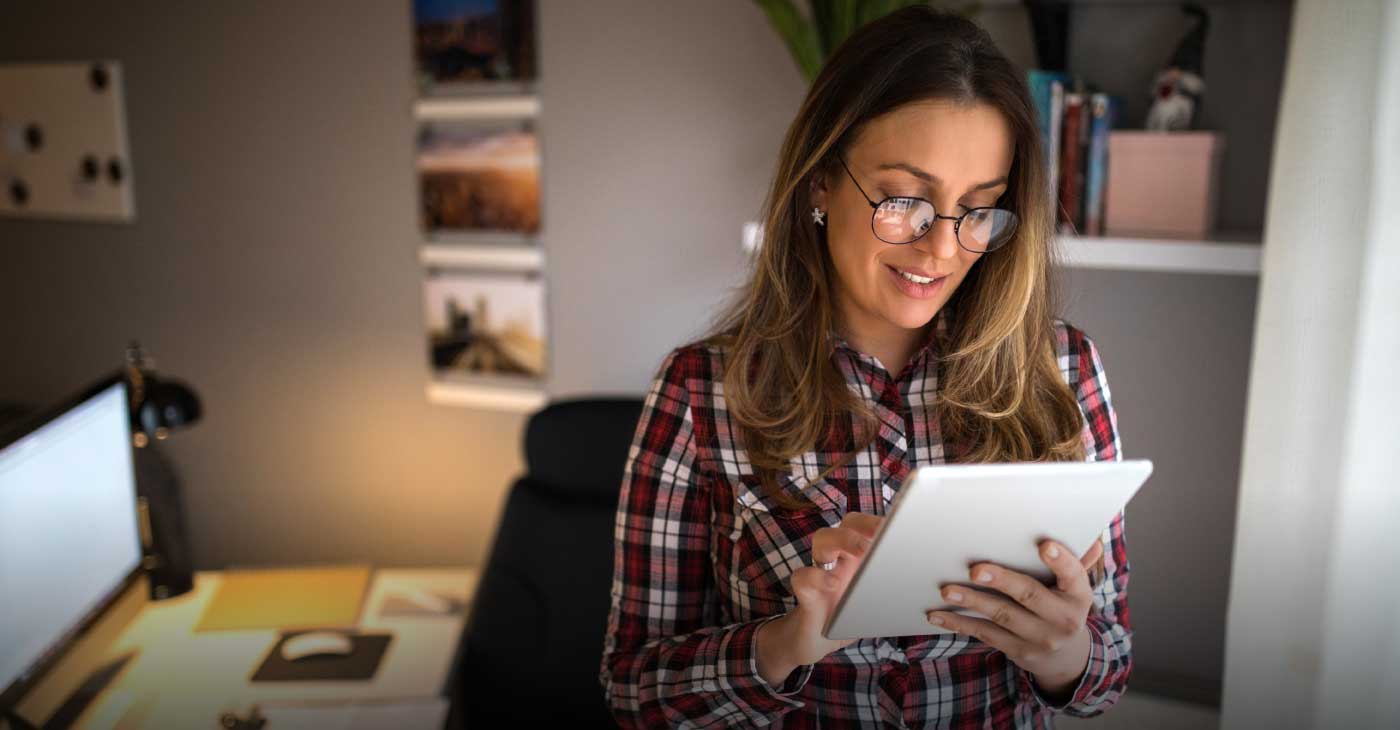

With the sudden proliferation of mobile devices that are taking over, an inordinate amount of the accesses that were not so long ago the sole domain of big deskbound tower computers, security has taken on a whole new dimension. The dangerous expansion of facilities that make it easy to log onto your accounts with a single gesture, combined with the fact that very few smartphone and tablet owners ever password-lock their devices, add up to the equivalent of walking around with hundred dollar bills hanging out your back pocket. Leave your smartphone on a restaurant table to go to the bathroom and by the time you’re back, you might already have suffered serious losses not only in your personal data but to your finances as well.

Basic Common Sense Procedures

There are various steps that you can take to set yourself aside from the vast masses of insecures, and they are all basic common sense procedures that should be incorporated into your daily routines:

- Password everything – It’s not going to ruin your day to spend an extra second or two entering a password to access your devices. You don’t have to go totally crazy and enter X6%Dy#3s[M7r|0W every time you want to use your smartphone as even shorter passwords will keep the casual data thief at bay.

- Multiplex your passwords – One of the biggest complaints about passwords is that it’s impossible to remember the dozens of different ones you use every day. Easy way to get around that: Come up with a good 6 digit password that is not directly personally identifiable (never your birthday, your kid’s name, etc.) then just add the first two characters of the website or function as the prefix to make it unique. So if you’re a closet Jersey Shore addict your universal 6 digit password is Sn00k1… then when you’re logging onto Paypal it’s PaSn00k1, or onto Chase Bank it’s ChSn00k1.

- Never just click away – There is a logoff function on every site that requires you to login, so use it! Even if a “device appropriator” doesn’t go after your personal or financial details they can quickly wreak havoc on your social networks by impersonating you!

- Set to Friends Only – It is one of the great puzzles of this century as to why some social network addicts insist on placing the most private information about their personal lives on those sites and then leaving them wide open for anyone to read, not just their own social circles. If you have to engage in personal data exhibitionism, then you should set all your social networks to “friends only” or other similar restrictions of access.

- Get out from under the Cloud – Cloud computing offers wonderful advantages for information access anywhere and anytime… not just for you but also for the evildoers who are after your data. Mat Honan, a writer for Wired, recently discovered the joys of losing everything he’d stored in the cloud when a hacker engaged in erasing his entire digital life. Even though the online world may be moving into the clouds, keep your critical data on terra firma by storing it in an encrypted format on your own device.

Don’t think that it can’t happen to you, as it can and will… unless you apply some basic security precautions right now!