Email Marketing for Financial Services

How to Stand Out in a Crowded Market ⭐

Email marketing is a highly effective way for financial services firms to engage with customers and prospects, build brand awareness, and generate leads.

Whether you're an asset management company, a bank, an insurance firm, or a financial advisor, email marketing can help you connect with your target audience and achieve your marketing objectives.

However, email marketing in the financial services industry is not without its challenges. With regulatory restrictions, high competition, and low open and click-through rates, it can be difficult to create effective email campaigns that drive results.

That's why we've put together this definitive guide to email marketing for financial services.

In this guide, we'll cover everything you need to know to create successful email campaigns that resonate with your target audience.

From building your email list and creating compelling content to optimizing your campaigns for deliverability and engagement, we'll share best practices and practical tips to help you get the most out of your email marketing efforts.

So, let's get started! 🚀

But first

Why should you invest in email marketing?

Email marketing is a crucial investment for the financial services industry, particularly as the demographics of customers continue to shift towards digital natives, including Millennials and Gen-Z.

Whether you're a fintech startup, lender, mortgage broker, bank, credit union, financial advisor, or any other type of financial services business, a well-executed email marketing strategy can have a significant impact on your success. By building brand awareness, establishing trust with your audience, and increasing engagement with your clients, email marketing can help you reach new heights in your business.

Email marketing offers a cost-effective way to connect with your customers on a regular basis and build a long-term relationship with them. By providing them with relevant and valuable content, you can position your business as a trusted authority in your field and establish your credibility. This, in turn, can increase your customers' willingness to invest with you, leading to increased revenue and profitability for your business.

Build Relationships: Email marketing can help financial service providers build and maintain relationships with clients. By sending regular emails, providers can keep clients informed about updates and changes in their services, as well as provide valuable financial tips and advice. This can help clients feel more connected to their provider and increase their trust in their expertise.

Attract New Clients: Email marketing can be a powerful tool for attracting new clients. Providers can use email campaigns to showcase their services and expertise, share client success stories and testimonials, and offer special promotions and discounts to new clients. By using email marketing to build awareness of their brand and services, providers can attract new clients and grow their business.

Email campaigns have an average conversion rate of 6.05%, which is higher than other marketing channels, such as social media and search engine marketing, according to HubSpot.

Increase Engagement: Email marketing can help financial service providers increase engagement with their clients. Providers can use email campaigns to invite clients to events, share industry news and insights, and promote other relevant content. By providing clients with valuable information and opportunities to engage, providers can deepen relationships with their clients and increase their overall engagement. Increasing engagement isn’t just about clicks and opens - all of the engagement ties back to the bottom line. Email campaigns that are personalized and segmented can result in a 760% increase in revenue, according to Campaign Monitor.

Personalized subject lines can increase open rates by 50%, according to Campaign Monitor.

Additionally, personalized emails can increase click-through rates by 14% and conversion rates by 10%, according to Aberdeen Group.

Drive Revenue Growth: Email marketing can be a powerful driver of revenue growth. Providers can use email campaigns to promote new services, upsell existing clients, and encourage clients to refer new business. By using email marketing to drive revenue growth, providers can help their business achieve new levels of success. The statistics back it up.

According to the Data & Marketing Association, email marketing has an average ROI of 42:1, making it one of the most cost-effective marketing channels.

Plus, with an average cost per email of just a few cents, according to Campaign Monitor, email marketing is one of the most cost-effective ways to reach your audience.

Overall, email marketing can be a highly effective tool for those in the financial services industry. By using the right platform and strategy, financial service providers can build relationships, attract new clients, increase engagement, and drive revenue growth.

Tips for Designing Financial Service Emails

Designing emails that convey trust is critical for financial service providers as clients are looking for confidence and credibility when it comes to financial matters. Here are some tips those in the financial service industry can use for designing emails that convey trust:

Use a professional and consistent design: Using a professional design that is consistent with your brand can help to establish trust with your audience. Make sure to use high-quality images and fonts that are easy to read.

Use plain language: Avoid using jargon and complicated language in your emails. Use plain language that is easy to understand and free of technical terms.

Be transparent: Be transparent about your business practices and services. Clients want to know they can trust you, so be upfront and honest about what you offer and how you can help them.

Provide educational content: Providing educational content that helps your clients make better financial decisions can help to establish trust and credibility. Clients want to work with providers who are knowledgeable and can help them navigate complex financial matters.

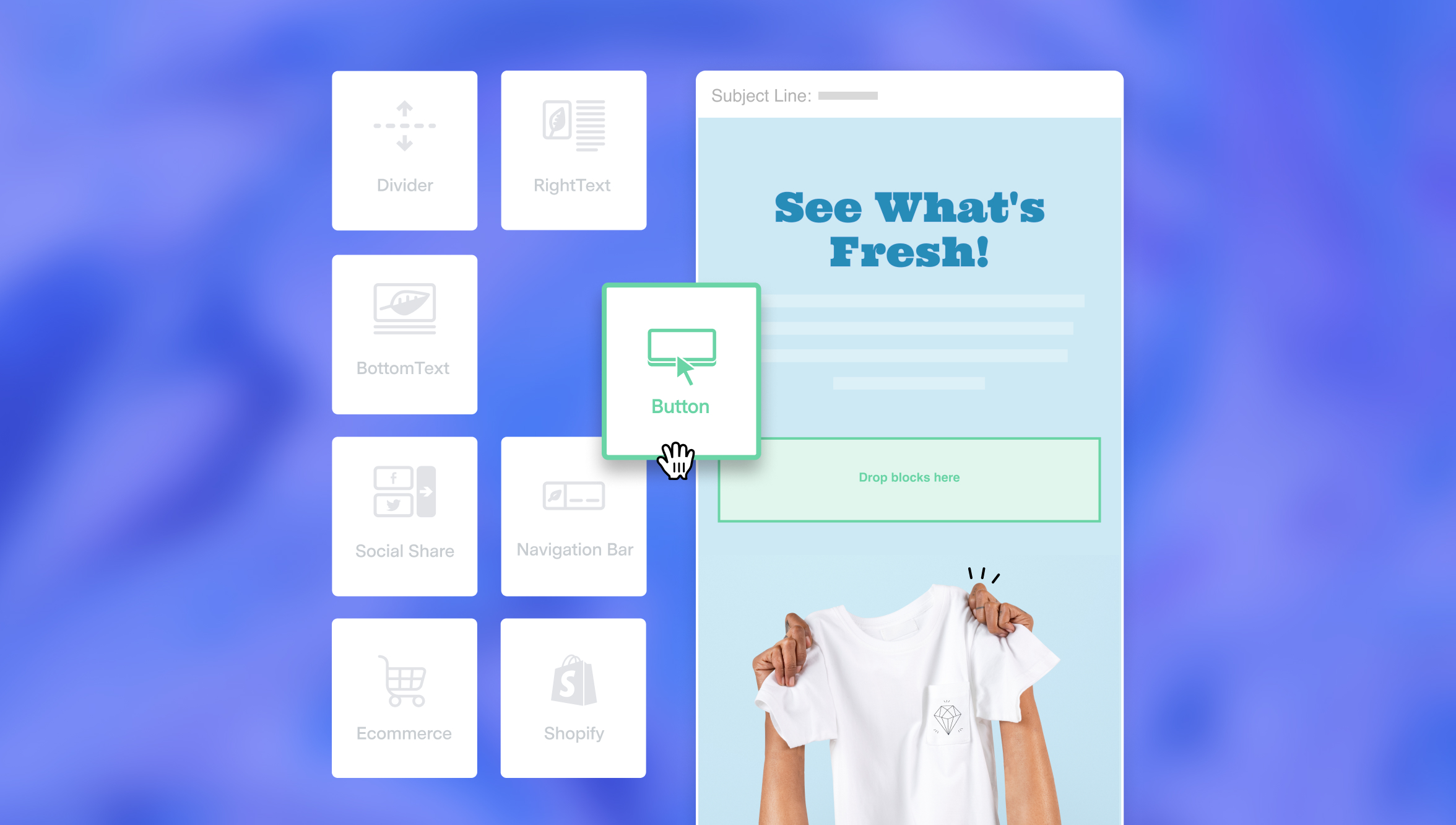

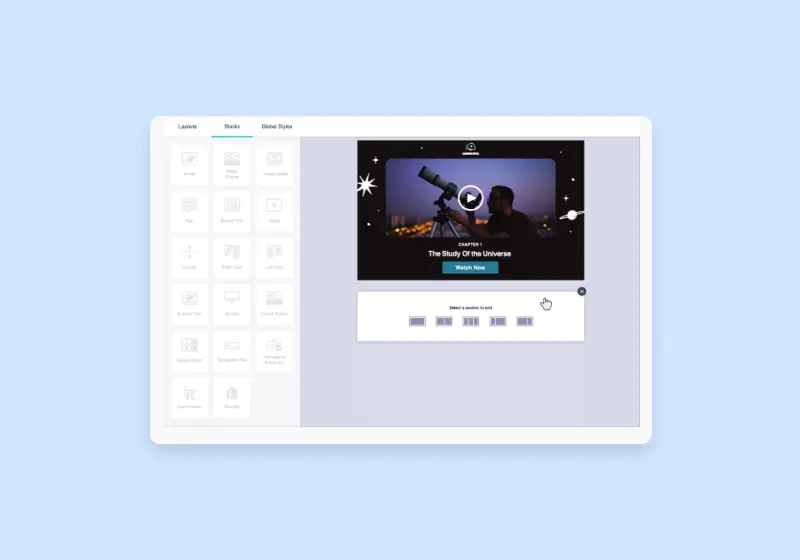

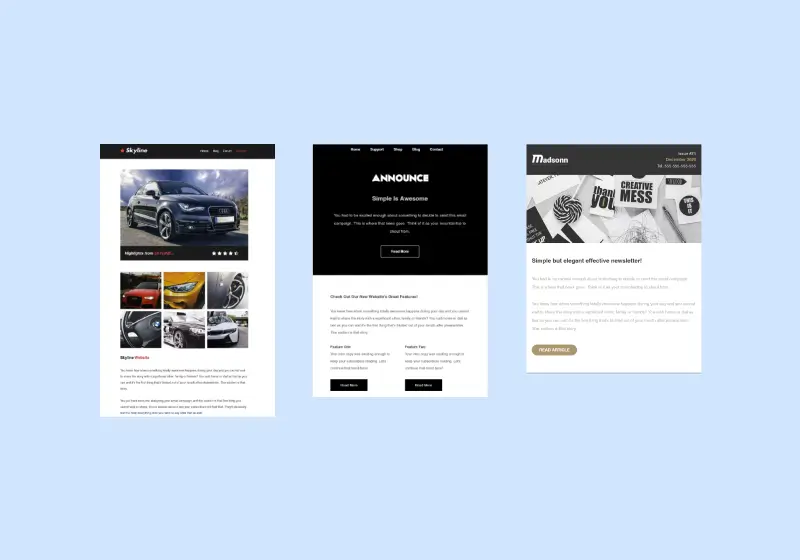

Leverage email templates. You’re likely not a design expert, and that’s okay! Instead of starting from scratch, start with a pre-designed email template and add your images and email copy. Adjust the template colors to match your brand and add your logo. Email templates provided by your email marketing software are also optimized to look great in the most popular desktop and mobile email clients, so you can be confident in your design when you hit “send.”

Include negative space: Using a professional design that is consistent with your brand can help to establish trust with your audience. Make sure to use high-quality images and fonts that are easy to read.

Include a clear call-to-action. Your emails should include a clear call-to-action that is easy to find and follow. Make it clear what you want the reader to do and why they should take that action.

Use customer testimonials: Including customer testimonials in your emails can help to establish trust with your audience. Social proof is a powerful tool, and hearing from other clients about their positive experiences can be very reassuring.

Be mobile-responsive. Over 80% of email users access their emails on mobile devices. Emails that are optimized for mobile devices have a higher open rate, click-through rate, and conversion rate, according to Litmus. Ensuring that your emails look great on mobile devices is key to reaching existing and prospective clients.

Provide clear and concise information: Provide clear and concise information in your emails. Clients want to know exactly what they are getting and how it will benefit them. Use bullet points and subheadings to help break up your content and make it easier to read. Link to landing pages or resources for more in-depth content.

Free Email Templates from Benchmark Email

Grab a template and customize in our drag and drop email builder - no coding or design skills required!

Send up to 3,500 emails per month for free.

By following these tips, financial service providers can design emails that convey trust and build strong relationships with their clients. Trust is a critical component of the financial services industry, and it's important to establish that trust through effective communication and messaging.

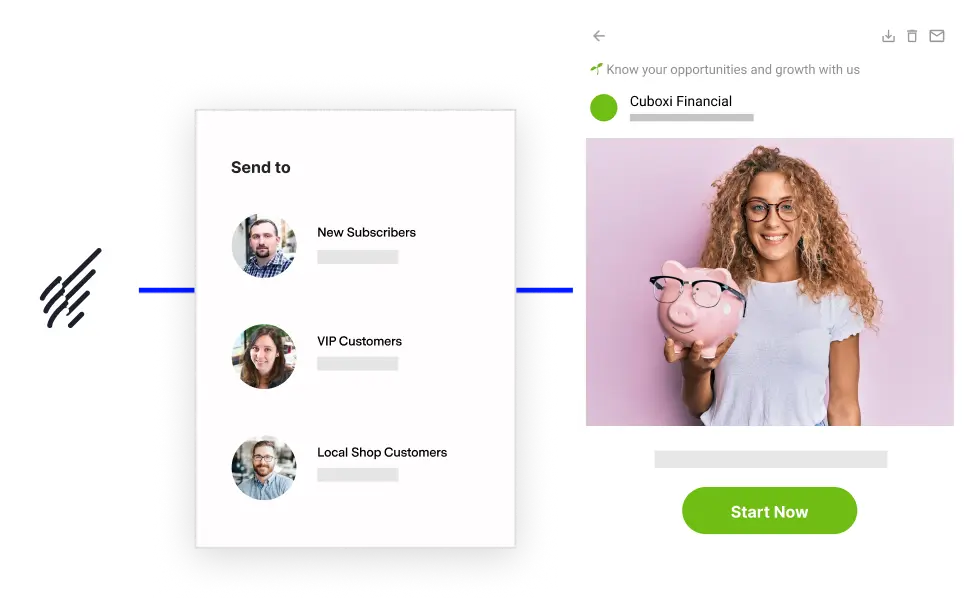

Delivering value through list segmentation

Just as important as a professionally-designed email is a properly segmented email list. Segmenting your email list is a crucial aspect of email marketing. By dividing your email list into smaller segments, you can create targeted and personalized email campaigns that are more relevant to your audience.

Here are some ways financial services firms can segment their email list:

Demographics: Segment your list based on demographic data such as age, gender, income, location, and occupation. This can help you create targeted messages that resonate with specific groups.

Interests: Segment your list based on the interests of your subscribers. You can use data from previous interactions with your brand, such as web browsing behavior and previous email interactions, to tailor your content and offers to specific interests.

Preference: Segment your list based on the interests of your subscribers. You can use data from previous interactions with your brand, such as web browsing behavior and previous email interactions, to tailor your content and offers to specific interests.

Financial status: Segment your list based on subscribers' financial status, such as investors, savers, and spenders. This can help you create content and offers that are tailored to their specific financial goals.

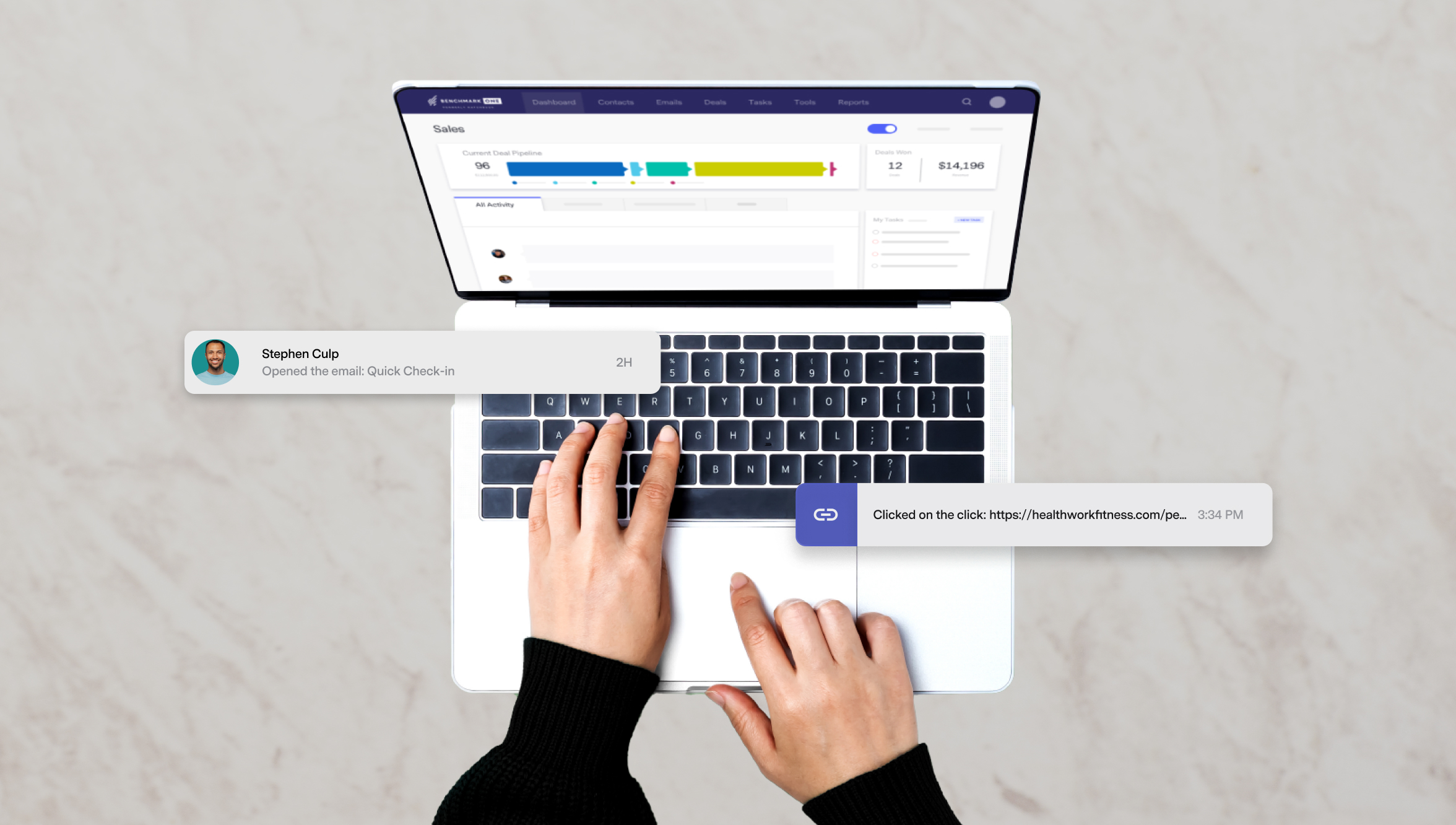

Behavior: Segment your list based on subscriber behavior, such as purchase history, email engagement, and website activity. This can help you identify and target subscribers who are more likely to convert into customers. Life cycle stage: Segment your list based on where subscribers are in the customer journey, such as new leads, active customers, or inactive customers. This can help you create targeted messages that are appropriate for each stage.

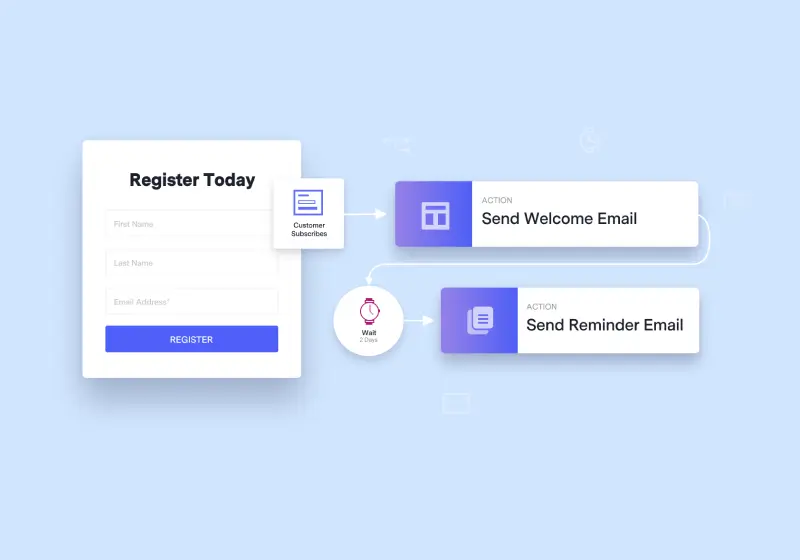

There are many intelligent ways to segment your list - and the best part is that you don’t need to do any of the heavy-lifting. With automation as part of your email marketing platform, you can dynamically segment your list and let your automation engine reach out with the right email message at the right time.

By segmenting your email list, you can create targeted and relevant email campaigns that resonate with your audience. This can help improve engagement rates, reduce unsubscribes, and increase conversions. It's important to continuously analyze your data and adjust your segmentation strategy accordingly to ensure your campaigns remain effective.

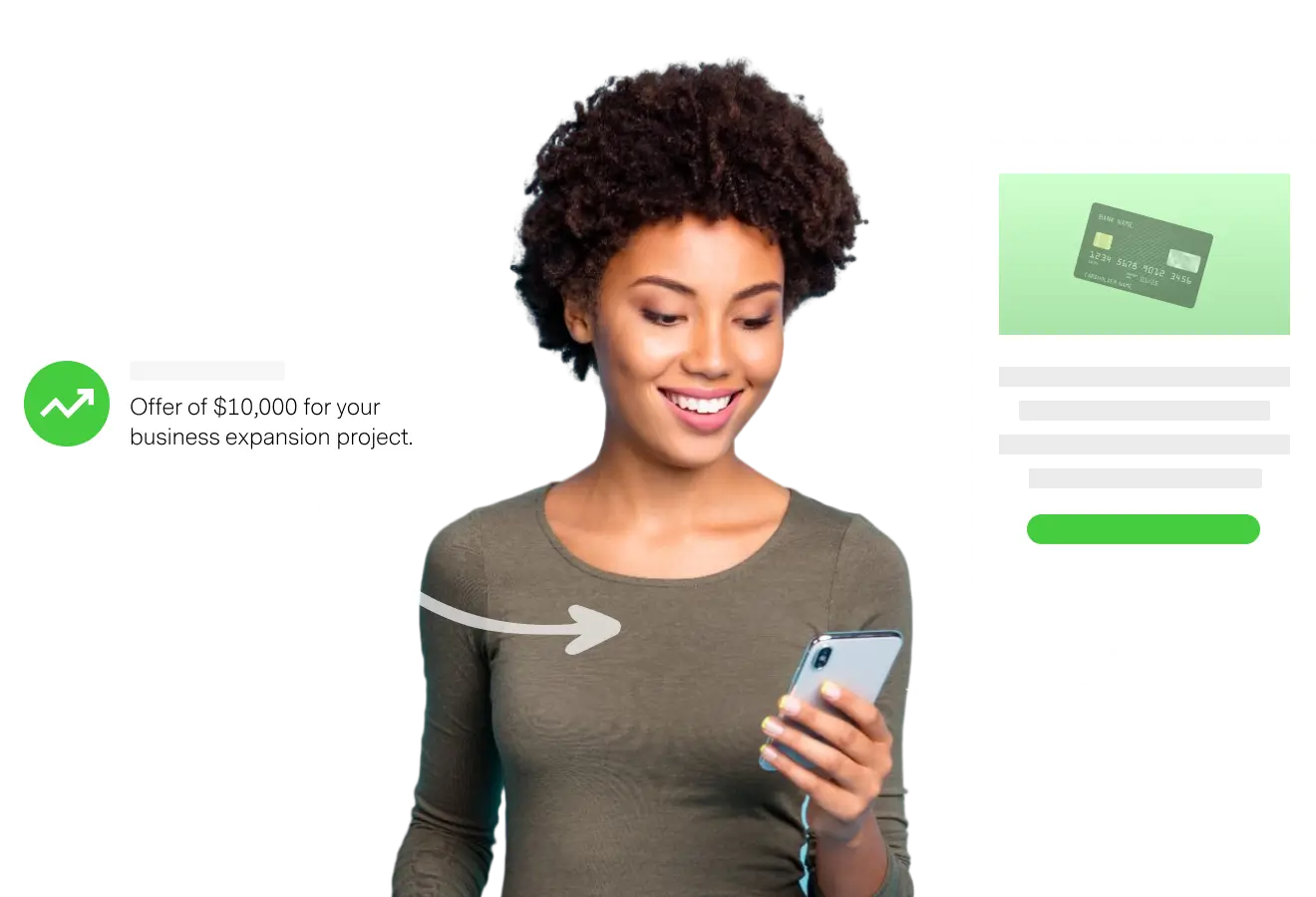

Personalizing Financial Services Emails

Once your list is segmented, email personalization has a key role in resonating with your segments. Email personalization is an effective way to connect with financial services customers and make them feel valued.

Here are some tips for personalizing financial

services emails:

Use the recipient's name: Addressing the recipient by their name is one of the simplest and most effective ways to personalize an email. Ensure that the recipient's name is spelled correctly, and consider using it in the subject line or greeting of the email.

Behavior: Financial services firms can use data such as customer demographics, past purchases, and engagement history to segment their audience into smaller groups. By targeting specific segments with relevant messaging, financial services firms can make their emails more personalized and engaging.

Make recommendations: Recommending products or services based on a customer's past behavior is an effective way to make an email feel more personal. Use data such as past purchases, search history, or abandoned carts to suggest products or services that the customer may be interested in.

Send triggered emails: Triggered emails, such as welcome emails or abandoned cart reminders, are sent based on a specific action taken by the recipient. These emails can be highly personalized and relevant, making them more likely to be opened and acted upon.

Segment your audience: Segment your list based on the interests of your subscribers. You can use data from previous interactions with your brand, such as web browsing behavior and previous email interactions, to tailor your content and offers to specific interests.

Use dynamic content: Dynamic content allows financial services firms to display different content to different recipients based on their interests or behaviors. This can include personalized recommendations for products or services, or tailored messaging based on the recipient's location or other factors.

Use personalized subject lines: Personalizing the subject line of an email can make it more likely that the recipient will open the message. Use data such as the recipient's location, past purchases, or interests to craft a subject line that is personalized and relevant.

By using these email personalization tips, financial services firms can create more engaging and effective emails that connect with their audience on a personal level.

Staying Compliant

Sending emails for financial services can come with some legal concerns. Here are some of the key legal considerations and ways to solve them

Compliance with financial regulations: Financial services companies are often subject to a range of regulations and laws related to financial disclosures, data privacy, and consumer protection. When sending emails, it's important to ensure that your messages comply with these regulations. This can involve working with legal counsel to review your email content and ensure it meets regulatory requirements.

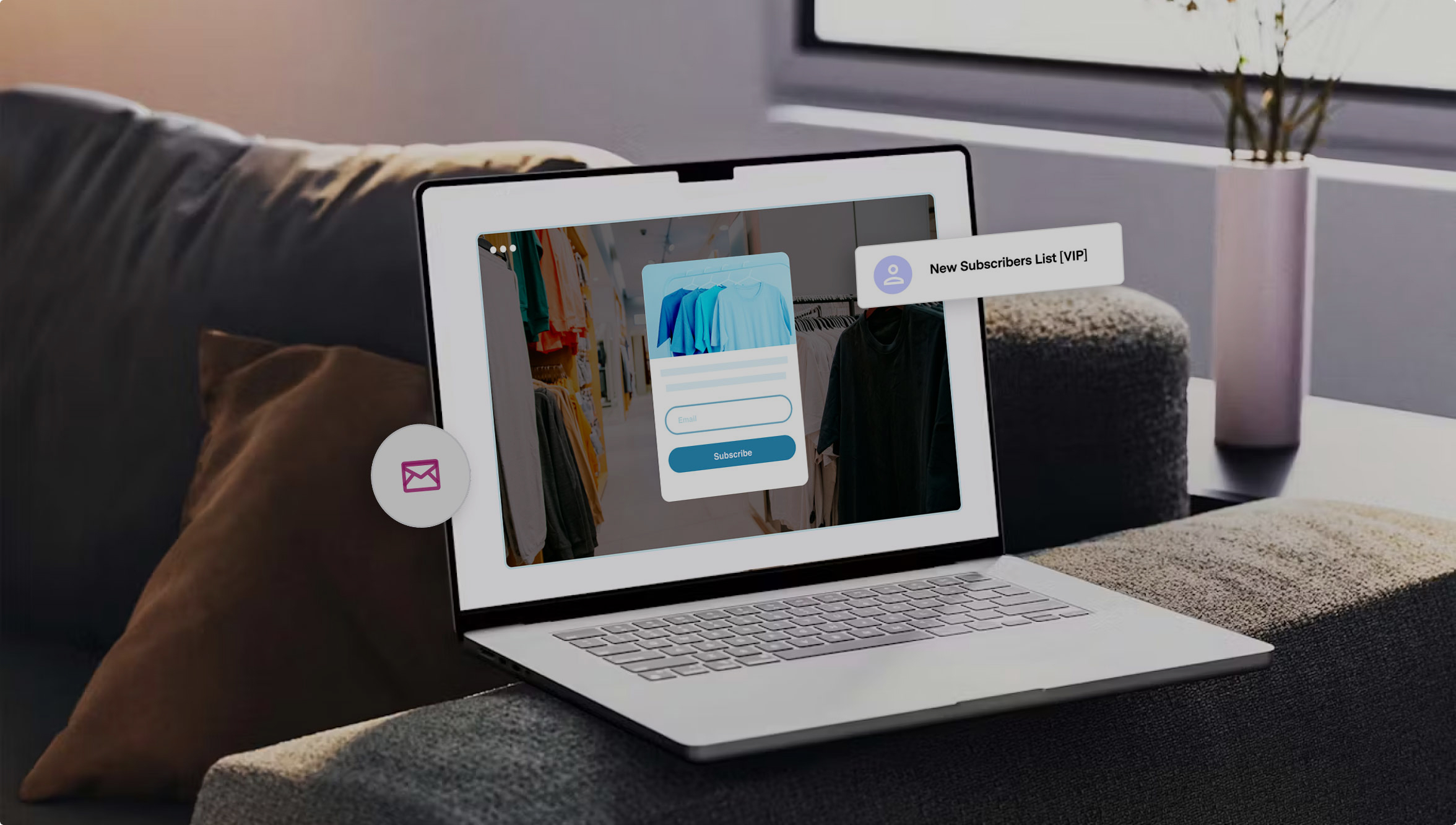

Permission-based marketing: To avoid running afoul of spam laws, it's important to make sure that your email list is composed of subscribers who have opted-in to receive your emails. You should always provide a clear and easy way for recipients to unsubscribe from your list, and honor those requests promptly. Your email marketing platform should make the opt-in and unsubscribe process easy and frictionless for you and your subscribers.

Data privacy and security: Financial services emails often contain sensitive personal and financial information, which must be protected. Make sure that your email system is secure and that your messages are encrypted to prevent unauthorized access. It's also important to ensure that your company's privacy policy is clearly communicated to subscribers, and that you follow best practices for data collection, storage, and management.

Accuracy of information: When sending financial services emails, it's important to ensure that the information contained in the messages is accurate and up-to-date. Make sure that you have systems in place to verify the accuracy of any financial or investment information provided in your emails.

Brand protection: There’s more to branding that just recall and recognition of your business. Financial services companies often have strict brand guidelines, which must be adhered to in all marketing materials, including emails. Make sure that your emails comply with your company's branding guidelines and do not use any copyrighted or trademarked material without permission.

By following these guidelines, financial services companies can ensure that their emails are legally compliant, secure, and effective in communicating with their audience. It's important to work with legal and compliance professionals to ensure that your email strategy aligns with regulatory requirements and best practices for financial services marketing.

Financial Services Email Campaign Ideas and Examples

We’ve covered the basics of increasing engagement and ROI through well-designed email templates that are personalized to a specific segment. Now let’s dive into some financial service campaign ideas and examples.

12 Email Campaign Ideas for Financial Service Providers

We’ve covered the basics of increasing engagement and ROI through well-designed email templates that are personalized to a specific segment. Now let’s dive into some financial service campaign ideas and examples.

Educational Content: Create emails that provide useful and relevant educational content related to personal finance, investing, and retirement planning. This could include infographics, eBooks, or blog posts.

Survey Campaigns: Use email to gather feedback from your customers on their experiences with your company and its products and services. This can help you identify areas for improvement and make adjustments to better meet their needs.

Upsell: Diversify your product offering to upsell products and services to your existing customers. Track the products your customers are currently using to segment them and present additional products and services they are most likely to use.

Personalized Recommendations: Use data to provide personalized recommendations to customers based on their financial history or preferences. This could include investment advice, debt consolidation strategies, or personalized retirement planning.

Account Updates: Send regular account updates to your customers, highlighting key account activity and providing useful insights and advice. This could include investment performance reports, account summaries, and other helpful information.

Welcome Series: Develop a series of emails that introduce new subscribers to your brand and its products and services. This could include highlighting the benefits of working with your company, testimonials from satisfied customers, or an overview of your services.

Newsletters: Create a monthly or quarterly newsletter that features industry news, company updates, and valuable resources for customers. This could include economic trends, market insights, and financial planning advice.

Product Launches: Use email to promote new products or services, highlighting the features and benefits of the offering. Consider offering a limited-time discount to incentivize customers to take action.

Event Promotion: Use email to promote webinars, seminars, and other events that your company is hosting or sponsoring. This could include highlighting key speakers or topics, and including links to registration.

Holiday Greetings: Send seasonal greetings to your customers, wishing them happy holidays and highlighting key financial considerations for the season, such as saving for holiday expenses or making end-of-year contributions to retirement accounts.

Referral Campaigns: Encourage customers to refer their friends and family to your company by offering incentives or discounts for successful referrals. Use email to promote the campaign and track results.

Partnership: Leverage a partnership with a brand to spread your message to a new audience. Choose a partner whose audience matches closely with your target. For instance, a credit union could team up with a local real estate agency to put on an event and cross-promote services.

Examples Financial Services Email Campaigns

Personalized Recommendations

Credit Karma provides a personalized recommendation on home equity based on user insights.

Newsletter

PayPal’s coupon-clipping app, Honey, highlights President’s Day deals in their monthly newsletter campaign.

Partnership

Ladder highlights their Life Insurance policy in a dedicated email to the BabyCenter audience of new parents.

Event Promotion

Protecht spreads the word about an upcoming webinar to increase brand awareness, increase engagement, and position itself as a thought leader.

Survey Campaign

Prudential reaches out to measure customer satisfaction and gather feedback through a survey request.

Education Content

Simmons Bank reaches out to educate and reassure customers during uncertain economic times, both building trust and providing next steps.

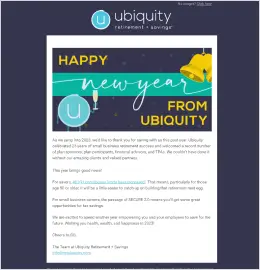

Holiday Greeting

Ubiquity users the new year as an opportunity to connect with their customers and educate them on opportunities for saving with Ubiquity.

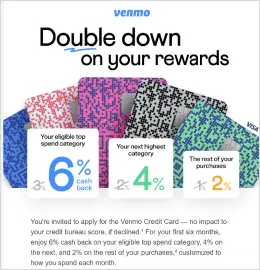

Product Launch

Venmo leverages their credit card product offering to upsell customers with limited-time offer to double their rewards.

Upsell

Zillow uses rising interest rates as an incentive to lock customers into a home loan.

Benchmark Email for Financial Service Providers

As a financial service provider, you know that building relationships with clients is essential to growing your business. But are you taking full advantage of the power of email marketing to engage with your clients and grow your customer base?

Benchmark Email is the solution you need. Our platform offers a comprehensive suite of tools and features that are designed to help you create effective email campaigns that get results. Whether you're looking to attract new clients, strengthen relationships with existing ones, or drive revenue growth, we can help.

We specialize in providing email marketing solutions for small business lenders, mortgage brokers, banks, and credit unions just like you. Our easy-to-use platform can help you create stunning email campaigns that capture your clients' attention.

Benchmark Email for Financial Services

Easy-to-use platform: Our user-friendly platform makes it easy to create engaging email campaigns that get results.

Customizable templates: Choose from a wide range of templates that can be customized to fit your brand and messaging.

Automated emails: Save time and increase engagement with automated email campaigns that can be triggered by specific actions or events.

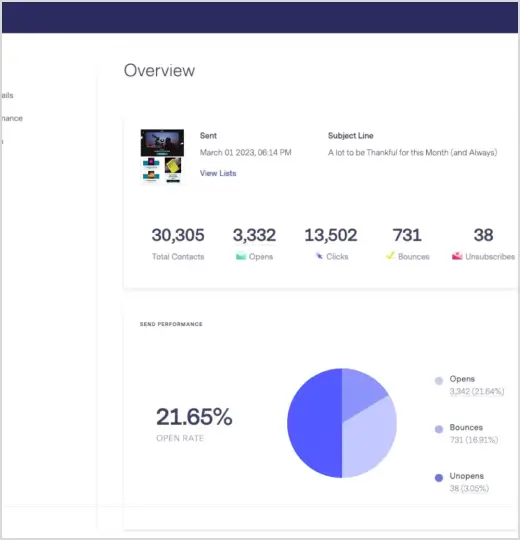

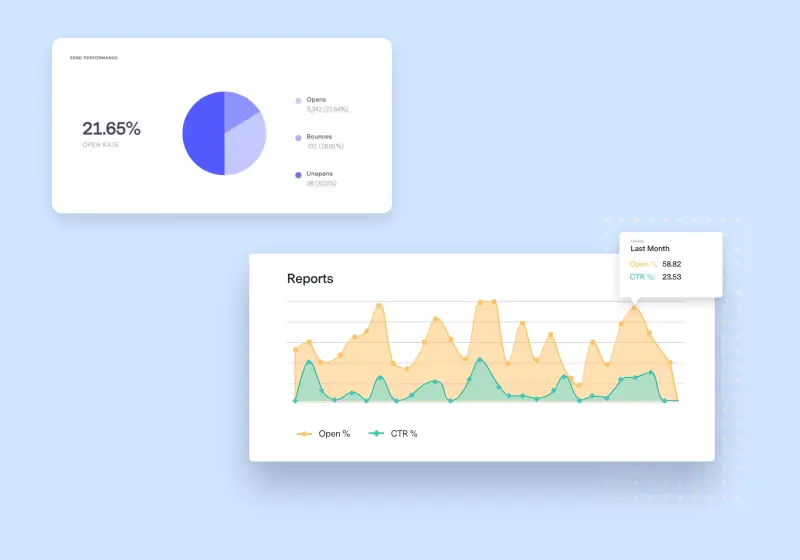

Advanced analytics: Track the success of your campaigns with detailed analytics that show you how your emails are performing.

Secure platform & Simple compliance: (double opt-in, unsubscribe, can-spam,etc)

Expert support: Our team of experts is always on hand to provide you with the support and guidance you need to succeed.

With Benchmark Email, you can take your email marketing to the next level and start seeing real results.

Sign up for a free account today and start engaging with your clients like never before!