In the dynamic landscape of the financial sector, the role of sales teams has never been more critical. Whether it’s attracting new clients, retaining existing ones, or navigating intricate financial products, success hinges on the ability of these professionals to deliver value and close deals. Yet, achieving this prowess demands more than financial acumen alone; it demands an arsenal of tools, knowledge, and strategies to thrive in the ever-evolving market.

Welcome to the realm of sales enablement, an approach that is fast gaining prominence in the financial sector, equipping sales teams with the right resources, skills, and support to excel in an industry where knowledge is power and timing is everything.

What is Sales Enablement for Financial Services?

Sales enablement is a strategic approach that equips sales teams with the tools, resources, knowledge, and strategies they need to engage prospects, close deals, and drive revenue effectively. It is a holistic framework aimed at enhancing the capabilities of sales professionals, ensuring they have access to the right information and support at the right time to engage customers successfully. In the financial industry, sales enablement takes on a specific and crucial role due to the complexity of financial products and the need for trust and expertise in client interactions.

Goals of Sales Enablement in the Financial Industry

The primary objectives of sales enablement in the financial sector are:

Improving Efficiency

Sales enablement streamlines workflows, providing sales professionals with the right resources at their fingertips. This efficiency reduces time spent on administrative tasks and increases time dedicated to client interactions.

Enhancing Productivity

By offering training, resources, and tools that optimize their performance, sales enablement helps financial professionals become more productive and effective in their roles.

Generating Revenue

Ultimately, the goal of sales enablement is to increase revenue generation. It equips sales teams to close deals more effectively, cross-sell financial products/services, and expand their client base, leading to increased revenue for their institutions.

Building Client Trust

Trust is the foundation of client relationships in the financial sector. Sales enablement ensures that financial professionals are well-prepared to provide accurate information and build trust with their clients.

Adapting to Change

The financial industry evolves rapidly with new products, regulations, and market dynamics. Sales enablement helps sales teams adapt to these changes, ensuring they remain competitive and relevant.

In a financial landscape where clients expect expertise and personalized advice, sales enablement is instrumental in empowering sales teams to meet these expectations. It enables professionals to operate efficiently, stay compliant, and, most importantly, provide exceptional value to clients, leading to revenue growth and long-lasting client relationships.

Financial Sales Enablement Tools and Technologies

Sales enablement in the finance industry relies on a wide array of tools and technologies designed to equip sales teams with the resources and support they need to excel. Here are some key tools and technologies that are instrumental in enabling financial professionals:

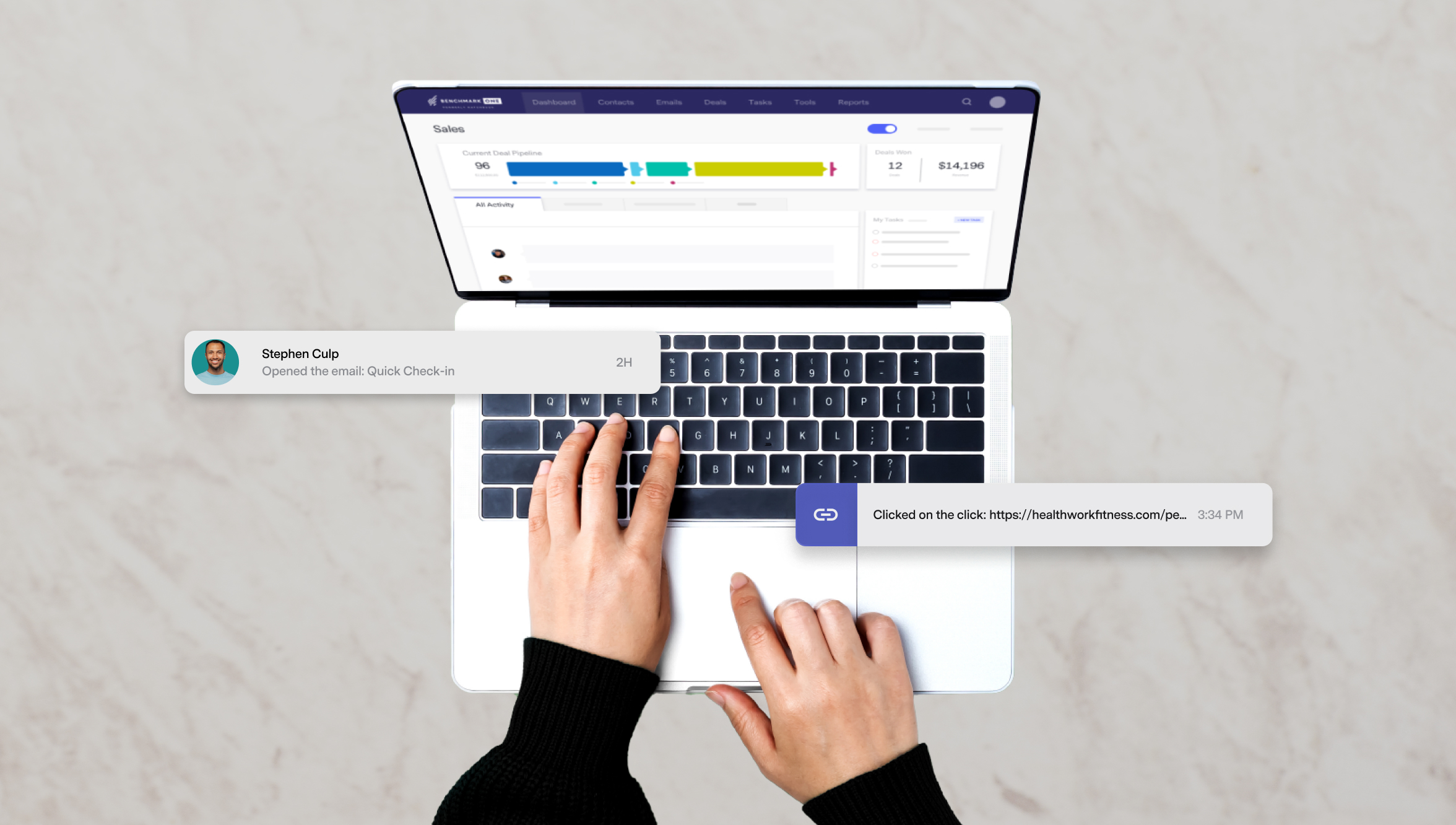

1. Customer Relationship Management (CRM) Systems

Role: CRM systems are the backbone of sales enablement in finance. They help sales teams manage client relationships, track interactions, and store vital client information.

Features: CRM systems offer features like contact management, lead tracking, deal pipelines, task management, and document storage. They allow sales professionals to stay organized and maintain a holistic view of their clients.

Benefits: CRM systems help financial professionals efficiently manage their client base, track client preferences, and engage in more personalized and timely interactions.

2. Data Analytics and Business Intelligence Tools

Role: Analytics tools provide insights into client behavior, market trends, and financial product performance. They help sales teams make data-driven decisions and target their efforts effectively.

Features: These tools can offer data visualization, predictive analytics, and reporting capabilities. They allow sales professionals to identify opportunities and tailor their strategies.

Benefits: Analytics tools empower financial sales teams to better understand client needs and preferences, predict market trends, and make informed recommendations, leading to improved sales outcomes.

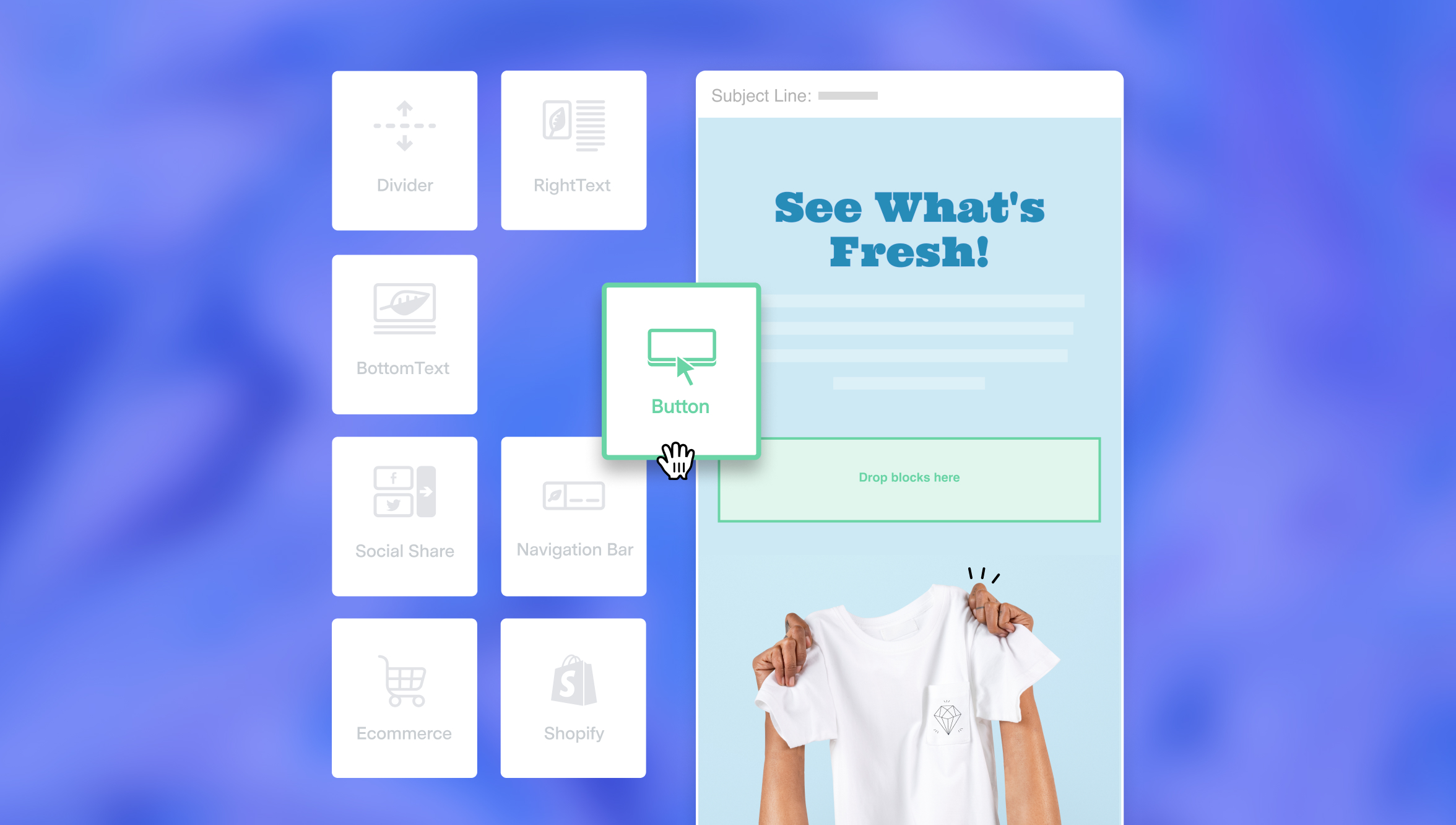

3. Sales Content Management Platforms

Role: Content management platforms facilitate the creation, storage, and distribution of sales collateral and content, such as presentations, articles, and educational materials.

Features: They provide document storage, version control, and content-sharing capabilities. Some platforms include features for content personalization.

Benefits: Sales content management platforms ensure that sales professionals have access to up-to-date, compliant, and client-relevant content, which enhances the quality of client interactions and the ability to present financial resources effectively.

4. Financial Planning Software

Role: Financial planning software aids in the creation of customized financial plans and projections for clients. It allows sales teams to illustrate the potential impact of various financial products on a client’s financial situation.

Features: These tools include financial calculators, scenario planning, and retirement planning modules.

Benefits: Financial planning software empowers sales teams to provide comprehensive and personalized financial advice, increasing the value they offer to clients.

5. E-learning and Training Platforms

Role: E-learning platforms offer training modules and courses that educate sales professionals on financial products, regulations, and client communication.

Features: They provide access to a library of educational content, progress tracking, and certification options.

Benefits: E-learning platforms enable ongoing education for sales teams, ensuring they stay up-to-date with financial industry knowledge and compliance requirements.

6. Communication and Collaboration Tools

Role: Tools like video conferencing, instant messaging, and collaboration platforms enable sales professionals to communicate with clients and colleagues efficiently.

Features: They offer video calls, chat functionality, file sharing, and collaboration spaces.

Benefits: Communication and collaboration tools facilitate remote client interactions, internal teamwork, and information exchange, enabling a seamless sales process.

These tools and technologies work in tandem to support financial sales teams in their efforts to engage clients effectively, make data-driven decisions, and enhance the overall client experience. In a highly regulated and data-driven industry like finance, they are indispensable for successful sales enablement.

Specific Sales Enablement Content and Its Benefits

Creating and curating sales enablement content, such as whitepapers, case studies, and educational resources, is crucial for supporting sales teams. These materials provide valuable information, evidence, and tools that empower sales professionals to engage with clients more effectively and drive sales. Here’s how content creation and curation can benefit sales teams:

1. Whitepapers

- Creation: Whitepapers are authoritative reports or guides that delve into complex financial topics, market trends, or investment strategies. They are typically created by subject matter experts within the organization.

- Curation: Sales enablement teams can curate external whitepapers from trusted sources, such as industry associations or reputable financial institutions.

- Support: Whitepapers offer in-depth insights that sales professionals can use to demonstrate their expertise and educate clients. They can be valuable resources for discussing complex financial concepts, regulations, and investment options.

2. Case Studies

- Creation: Case studies highlight real-world success stories of how the company’s financial solutions addressed clients’ needs and challenges. They are created based on actual client experiences.

- Curation: Curated case studies can include success stories from similar financial institutions or financial advisors, showcasing industry best practices.

- Support: Case studies provide tangible evidence of the company’s ability to deliver results. Sales professionals can use them to illustrate the impact of their solutions and build trust with potential clients.

3. Educational Resources

- Creation: Educational resources encompass a wide range of materials, including webinars, videos, blog posts, articles, and e-books, designed to educate clients and prospects on financial topics.

- Curation: Sales enablement teams can curate external educational resources, such as relevant articles or industry reports, to supplement internal content.

- Support: Educational resources help sales teams educate clients, answer their questions, and provide value beyond just selling products. They position the sales professionals as knowledgeable advisors.

4. Sales Presentations

- Creation: Sales presentations are customized materials that provide an overview of the company’s services, products, and value propositions. They are tailored to specific client needs.

- Curation: Curation may involve including industry statistics, market insights, or regulatory updates from external sources to enrich sales presentations.

- Support: Sales presentations are essential for client meetings and pitches. By incorporating external data and insights, they become more informative and persuasive.

5. Compliance Documentation

- Creation: Compliance documentation includes materials that explain regulatory compliance requirements, policies, and procedures for sales professionals.

- Curation: Curated compliance updates and guidelines from industry regulatory bodies can help keep sales teams informed about the latest compliance standards.

- Support: Compliance documentation ensures that sales teams adhere to industry regulations. Staying up-to-date with external compliance requirements is critical in the financial sector.

Creating and curating these sales enablement materials equips sales professionals with the resources they need to engage clients effectively. It helps them build credibility, address client concerns, and provide valuable information, ultimately leading to more successful client interactions and increased sales in the financial sector.

By following this framework, financial institutions can establish an effective sales enablement program that aligns sales and marketing efforts, offers valuable content, prioritizes training and coaching, and maintains a client-centric approach. This approach will help sales teams excel in the highly competitive financial sector and drive revenue growth while ensuring compliance with industry regulations.